Looking for information on how to reduce fraud and chargebacks? Check out these fraud prevention and control best practices for risk management and e-commerce security. Doing the little things can make a big difference.

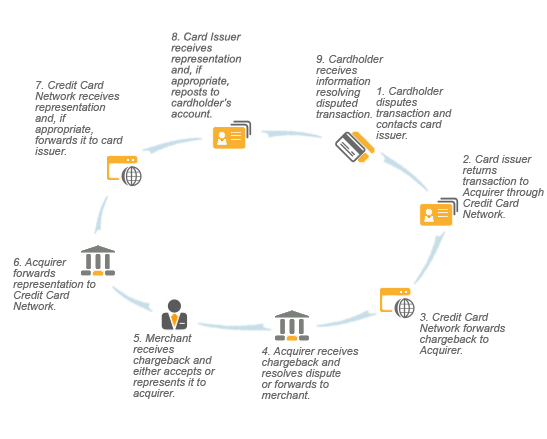

The Chargeback Process

- Use Address Verification System (AVS) on all incoming transactions; shipment of product should only be sent to an address that has been verified and associated with the credit card that generated the transactions

- Require signature on all product deliveries

- Use Card Identification Number (CID and CVV2) on all incoming transactions. On the majority of Visa credit cards, this is a 3-digit security code that acts as an additional verification measure and provides some assurance that the cardholder is in possession of the credit card

- Credit Card Descriptor – Clearly convey your merchant name, location and customer service telephone number in order to clearly identify your transaction on your customer’s statement

- Use Soft Descriptors – For online merchants, soft descriptors can be used as an extension of the credit card descriptor to identify individual transactions

- Credit Card Authorization – To avoid technical chargebacks, be sure to settle all transactions in a timely manner and do not settle transactions with invalid authorization number

Refund Policy

- Provide a clear explanation of all policies with regard to refund, return or customer service related issues on all invoices, promotional materials and websites

- Post customer policies in a conspicuous and accessible place

- Increase the timeframe in which a customer can request a refund

- Create an open line of communication for your customer to contact in case there are customer service issues via telephone or email

- Restocking Policy – Implementation of a Restocking Fee may cause partial or full chargebacks

Recurring Transaction Maintenance

- Daily maintenance of your recurring transaction

- Remove all customers from your recurring transaction database in a timely manner

Fraud Monitoring

- Create a Negative Database of all customers that issued a chargeback for the purpose of denying future transactions and website access in the future

- Create a dedicated team of employees to review daily transactions for the purpose of identifying blatantly fraudulent activity and support customers service issues that may cause future cardholder disputes

- Create a rule-based report that identifies high-risk transactions characteristics (i.e. foreign transactions, multiple transactions, on cardholder’s card, etc.)

- Employ & Implement a Risk Management Software package that could help you identify high-risk transactions (i.e. CyberSource, Retail Decisions, ClearCommerce,Volance etc.)

- Website Warnings – Clearly state your policy with regard to credit card fraud on your billing page and report all fraudulent incidents to the proper authorities

- Bank Identification Number (BIN) Blocking – Block the acceptance of credit numbers related to high-risk areas (i.e. West Africa, Eastern Block Nations, Pacific Rim Nations, etc.)

- Internet Protocol (IP) Blocking – Block transactions generated from IP’s originating from high-risk areas (i.e. West Africa, Eastern Block Nations, Pacific Rim Nations, etc.)

If you get a chargeback pay attention to the Chargeback Debit Advise that is sent and pay close attention to what is being requested. Be sure to send everything you have but specifically what is being requested. Typically the retrieval request always is asking for the merchant to provide the actual sales receipt/imprint that was signed by the customer.

Additionally, when the card is present (retail) merchants should always swipe the card and get the cardholder to sign the receipt or imprint with signature. Even if the customer is signing a contract, invoice, etc they have to swipe the card and get the cardholder’s signature on the sales receipt/slip whenever possible. If the card is not present (MOTO) then merchants should always get an invoice, confirm AVS is a match, ship to only the confirmed billing address and get valid proof of delivery. The riskier scenario is the keyed transactions because ultimately if it does go through and a chargeback comes in for fraud, merchants often lose.

Identify CNP (Card-Not-Present) Fraud Indicators

Please reference Visa and MasterCard’s websites directly for more detailed tips:

http://www.mastercard.com/us/merchant/security/fraud_prevention.html