Can’t keep your ACH return ratios within thresholds? Try an alternative solution.

Got a problem with ACH returns? Try something else. Try an alternative that allows higher return rates. Read this page to learn more about it and use the contact form to get in contact with us if you are interested in this solution.

An ACH processing account is essential for many different types of businesses. The ability to ACH debit a customer’s account to collect a payment due is essential for the operation of many businesses. But some business types, due to the demographic of their customers, have a hard time keeping their ACH return ratios within NACHA rules thresholds of 15% overall, 3% administrative, and 0.5% unauthorized return chargebacks. And as a result, getting approved for a high risk ACH process account can be somewhere between difficult and impossible — and even if you can get approved, you won’t keep the account if you can’t keep your returns within thresholds.

Fortunately there is a solution for higher risk merchant types that commonly struggle with higher return rates.

Instead of sending transactions through the ACH network governed by NACHA and their strict “Operating Rules”, use the check processing network that is not as strict.

Use Check Processing Instead

The check processing industry was modernized thirteen years ago to allow for the electronic delivery and processing of check images, which is still used today – and benefiting from new technology that makes the processing of checks as easy as the processing of ACH transactions.

Need a virtual terminal for smaller numbers of transactions – supported. Need a secure transmission of bulk files – supported. Very similar to ACH in many ways – funds come out of your customer’s bank checking account and deposit into yours.

An importance difference is the clearing time. Higher risk ACH is commonly 4 business days. With check processing the settlement times are more like 7 business days.

For merchants that do good business, but just happen to get a lot of returns due to the demographic of their customers like consumer lenders, collection agencies, etc this solution is saving their business. Does your business urgently need to set up a new account? If so, we can likely help.

In our payment consulting practice, we commonly recommend setting up more than one payment account “just in case”. So even if you have an ACH processing account in good standing and you haven’t been shut down yet, it might be a good idea to set up another account. Based on years of experience helping our clients with payment processing needs, we have found best practice is to set up a check processing account and use it for “new customers” that are untrusted and do not have a history – then use ACH for the “customers that have a proven payment history”. This is the best way to balance the transactions. This will protect the ACH account and keep the return ratios lower while you offload the transactions with higher risk of returns off to the check processing network where returns don’t matter as much.

The virtual terminal for the check processing system looks similar to the virtual terminal used for ACH. Where it differs is on the back-end in how the processor submits the files to the bank. The route/path is different but the end result is the same – the money shows up in your bank account (any US bank account – not just certain bank accounts). Cut off times are the same as ACH.

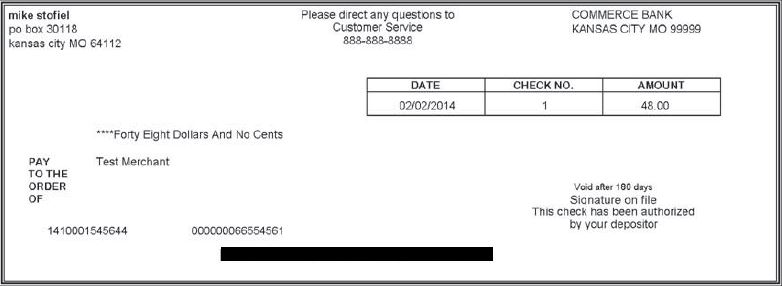

Here is a sample check which is what will appear on the customer’s bank statements when they click the transaction details in their online banking. It will show like the customer wrote you a check and you deposited it. The customer essentially gives you permission to write a check on their behalf for the purposes of making the payment. You need to obtain written authorization of course.

One thing I will point out is that there are differences in check drafting solutions in the marketplace. The way check drafting works is if the merchant submits a transaction, the processing provider will take that transaction information and convert it into an actual physical paper check and deposit it into the merchant’s bank account. Although this is a much faster way for the merchant to receive their funds, it is also risky as the returns are happening within the merchant’s own bank account. So if you are not careful, you will lose your bank account. Don’t lose your bank account using the wrong solution.

In the check processing solution we offer, the returns are managed by the processor; the only time the merchant bank account is used is for settlement of funds so merchants are not risking getting their bank account shut down due to NSFs or what have you.

Underwriting is the similar as it is for ACH with prohibited and restricted lists of merchant types. The primary difference is in the return ratios. The processor is a lot more lenient on check returns processed; meaning if a merchant comes through with statements showing that they’re out of compliance with their ACH processing, we’re not going to turn it away for that reason. That is probably the primary reason why a merchant chooses to use check processing vs ACH.

With check processing, the processor manages the returns and accepts liability if anything goes bad. The process will receive most return notification from the RDFI electronically, but there is a possibility that the small town community banks don’t have that capability, so they will send a manual return which costs more to process for obvious reasons. This is good because it means that your bank account will not be at risk.

Account verification tools can be used as well to help keep costs of returns down – so you know the account is valid in good standing before sending the payment through. Additional per transaction fees apply.

Similar to higher risk ACH, a reserve is often required for merchants with higher return rates. The reserve can be rolling or upfront with 7 business day settlements. Settlement schedules and reserve requirements are subject to underwriting.

Pricing is also similar to high risk ACH processing with fees for application underwriting, monthly fees, per item/transaction fees, then fees for returns (with manual returns costing more), fees for unauthorized chargebacks and a discount rate.